¶ ZATCA Response Reconciliation

¶ ZATCA Responses

Once onboarded for Phase 2 on ZATCA, every tax document created will automatically be submitted to ZATCA, regardless of the channel used to generate it.

ZATCA will respond with one of the following statuses:

- PASS: The tax document is approved. No further action is required.

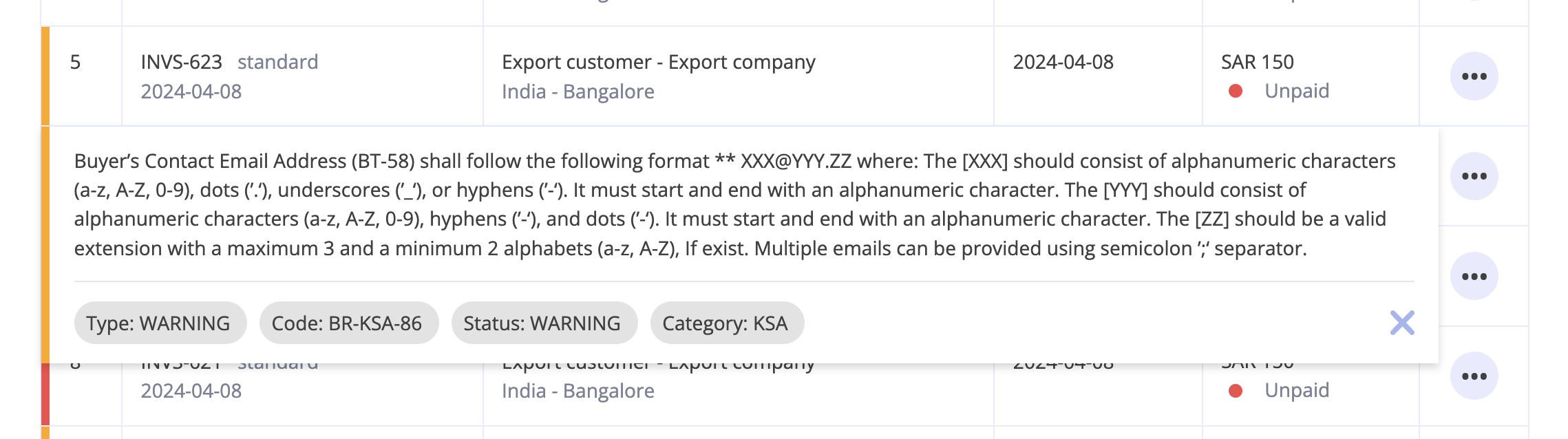

- WARNING: The tax document is accepted but with warnings. It can still be issued to the customer. It's recommended to address the warning in future documents.

- ERROR: The tax document has been rejected. You must correct the issues and resubmit the document to ZATCA.

¶ Checking Warnings or Errors

¶ Web Application

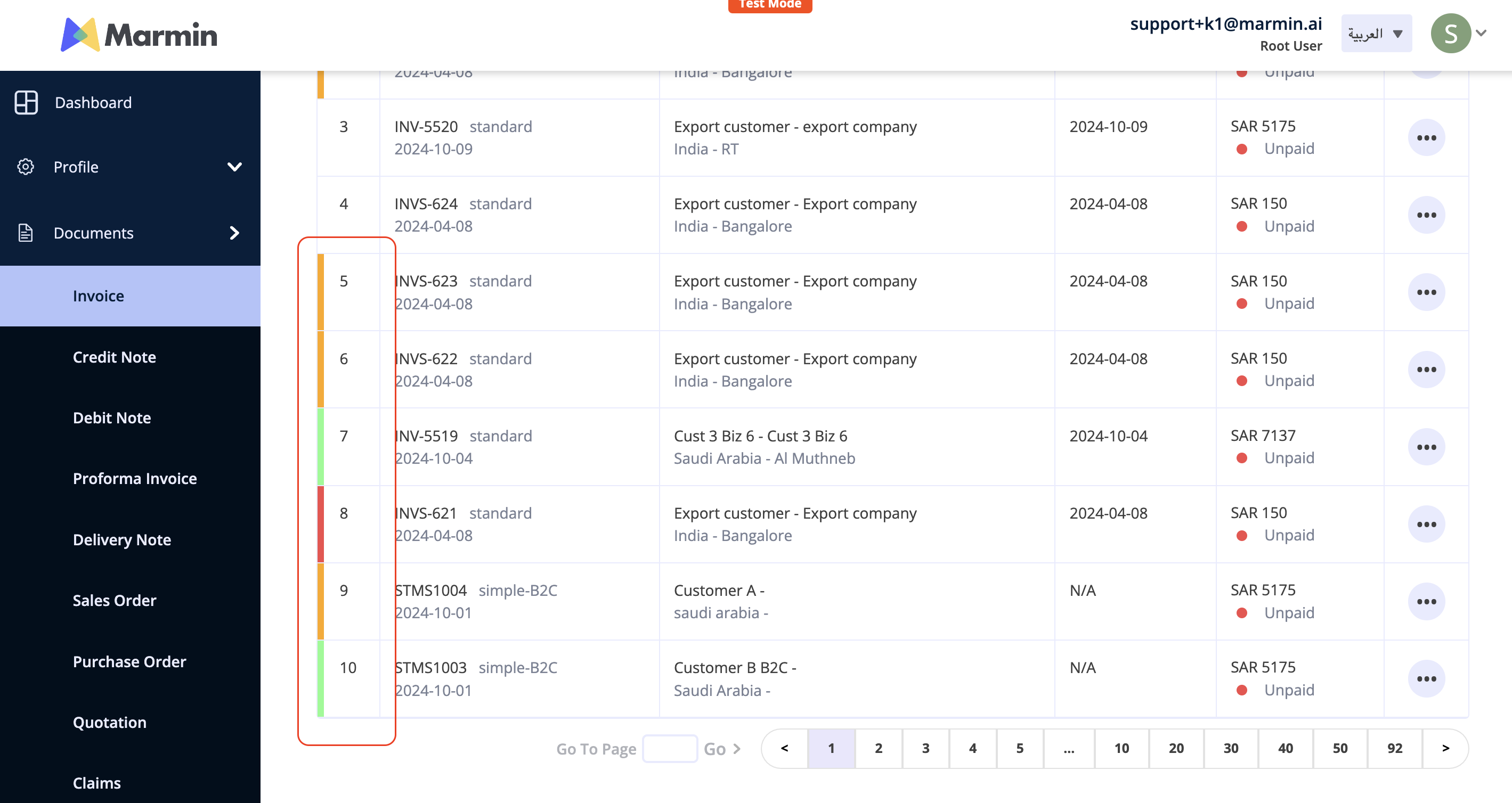

- Navigate to the Tax Document Listing page.

- Click on the Serial Number of the document you want to inspect.

- A detailed error or warning message will be displayed.

¶ API Integration

For users creating tax documents via the API, any warnings or errors will be returned in the API response.

¶ Rectifying Rejected Tax Documents

If a tax document is rejected:

- Find the document on the Tax Document Listing page.

- Click the Action Button next to the rejected document.

- Select Edit to Resubmit. All original document details will be copied over for editing.

- Make the necessary corrections and resubmit. A new tax document with updated details will be created, while the original document number is maintained.