¶ Getting Started with Marmin E-Invoicing for Shopify

Welcome to the Marmin E-Invoicing guide for Shopify merchants. This wiki will walk you through how to set up ZATCA-compliant e-invoicing for your business in Saudi Arabia.

¶ What is Marmin E-Invoicing?

Marmin helps Shopify merchants easily comply with KSA's ZATCA e-invoicing requirements. Instead of manually creating compliant invoices, Marmin automates the entire process, saving you time and ensuring you stay compliant by automatically generating Phase 1 and Phase 2 invoices and refunds for both B2C and B2B customers.

¶ Setting Up Marmin with Your Shopify Store

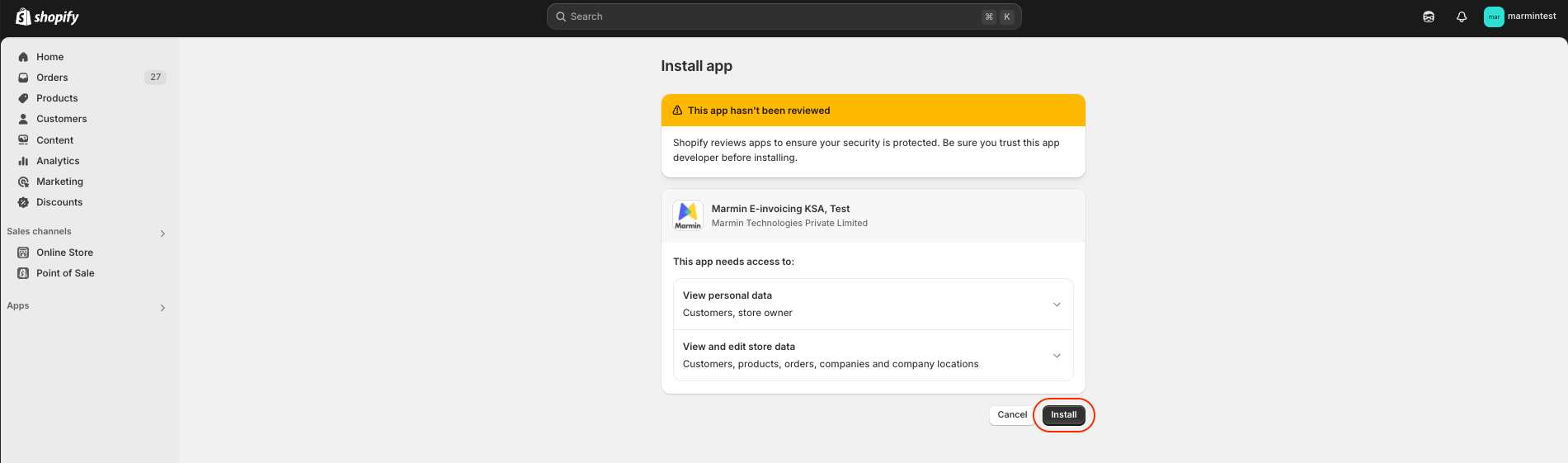

¶ Step 1: Install Marmin from the Shopify App Store

Head over to your Shopify App Store and search for "Marmin E-Invoicing." When you find it, click "Install" to begin the process. You'll see a permissions page showing what data Marmin will access from your Shopify store - this is necessary for the app to work properly.

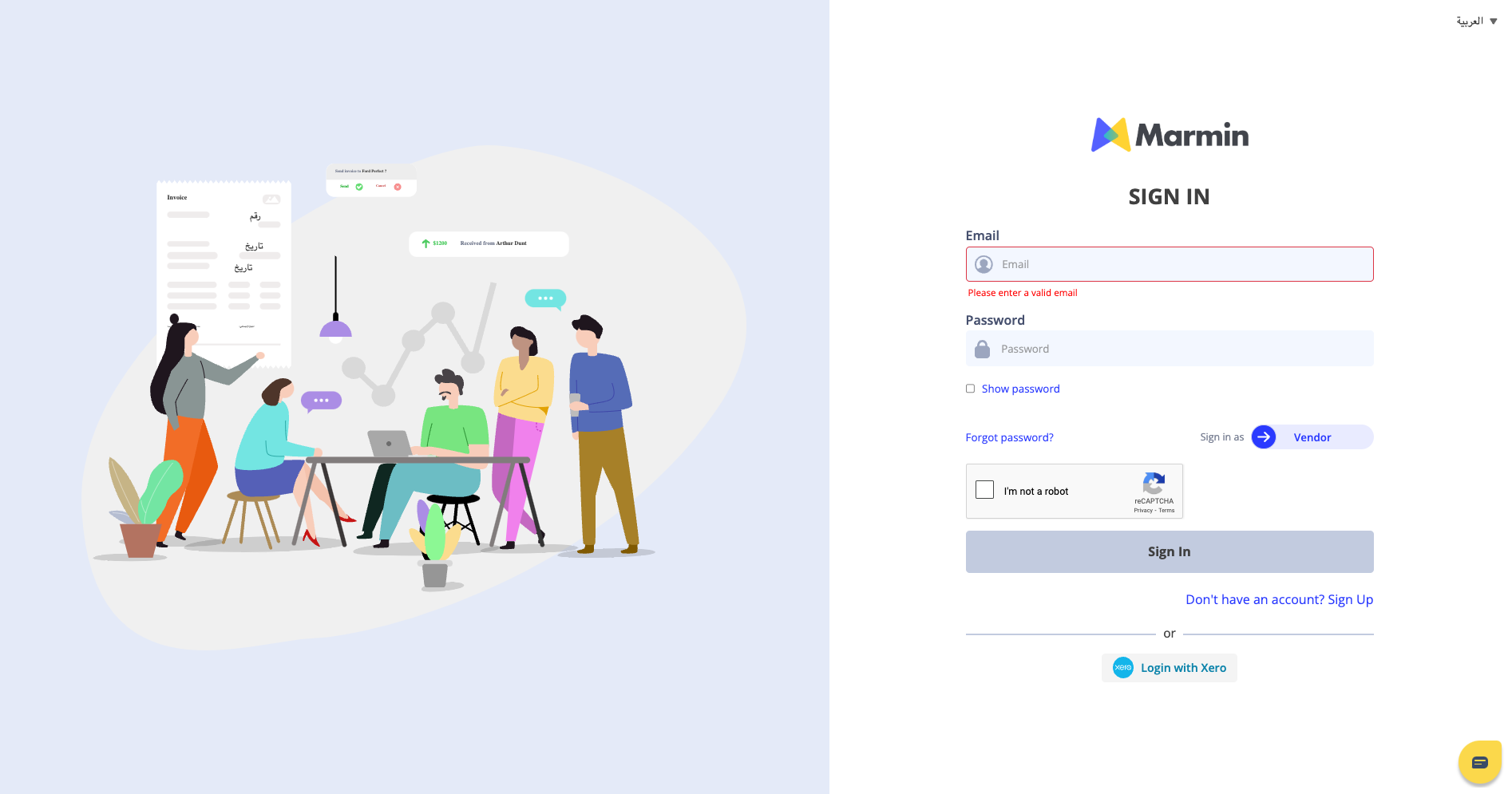

¶ Step 2: Prepare Your Marmin Account

Before completing the Shopify installation, make sure you've created an account on Marmin's platform, https://app.marmin.ai/login. This is really important! You'll need to set up:

- Your business profile

- Your bank details

These two pieces of information are mandated by ZATCA regulations for generating compliant e-invoice.

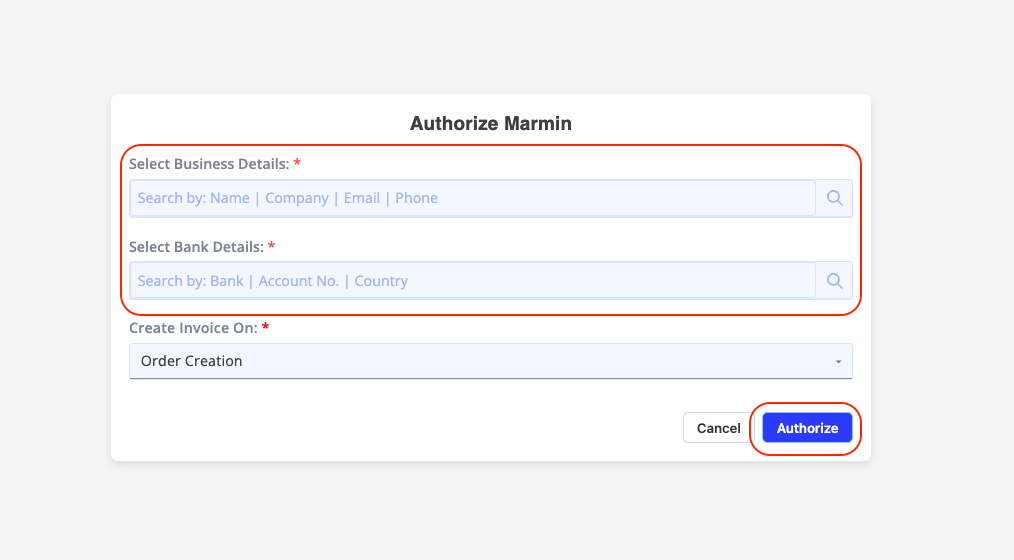

¶ Step 3: Connect Shopify to Marmin

After clicking "Install" from Shopify, you'll be redirected to Marmin's platform. Here you'll see the "Authorize Marmin" page where you need to:

- Select your default business profile

- Select your default bank profile

- Choose when to generate invoices

- This is an important decision based on your business model. Marmin lets you generate invoices at different stages of the order process:

- When an order is created

- When an order is paid

- When an order is fulfilled

- This is an important decision based on your business model. Marmin lets you generate invoices at different stages of the order process:

Different business types need different triggers. For example, if you run a franchise, concession, or consignment business, your needs might be different from a standard retail model. Choose the option that best fits your business practices.

¶ How Invoice Generation Works

Once everything is set up, Marmin works automatically in the background:

For Phase 1 accounts: When your chosen trigger event happens, an invoice is generated directly in Marmin and sent to your business.

For Phase 2 accounts:

- When your chosen trigger event happens, an invoice is created in Marmin

- Marmin sends it to ZATCA for approval

- Once ZATCA approves the invoice, it's automatically emailed to both you and your buyer

This automation makes ZATCA Phase 2 compliance much simpler than handling it manually.

¶ Need Help?

If you run into any issues or have questions during setup, our support team is ready to help! Contact us at support@marmin.ai.

¶ Initial Shopify Settings for Selling in Saudi Arabia (KSA)

This guide will walk you through the initial Shopify setup required to start selling in Saudi Arabia. These steps are essential before integrating with the Marnin platform for e-invoicing. We will cover:

- Adding and activating a new market for KSA.

- Setting up shipping zones.

- Configuring tax rates.

- Setting the store currency.

- Choosing between tax-inclusive or tax-exclusive product listings.

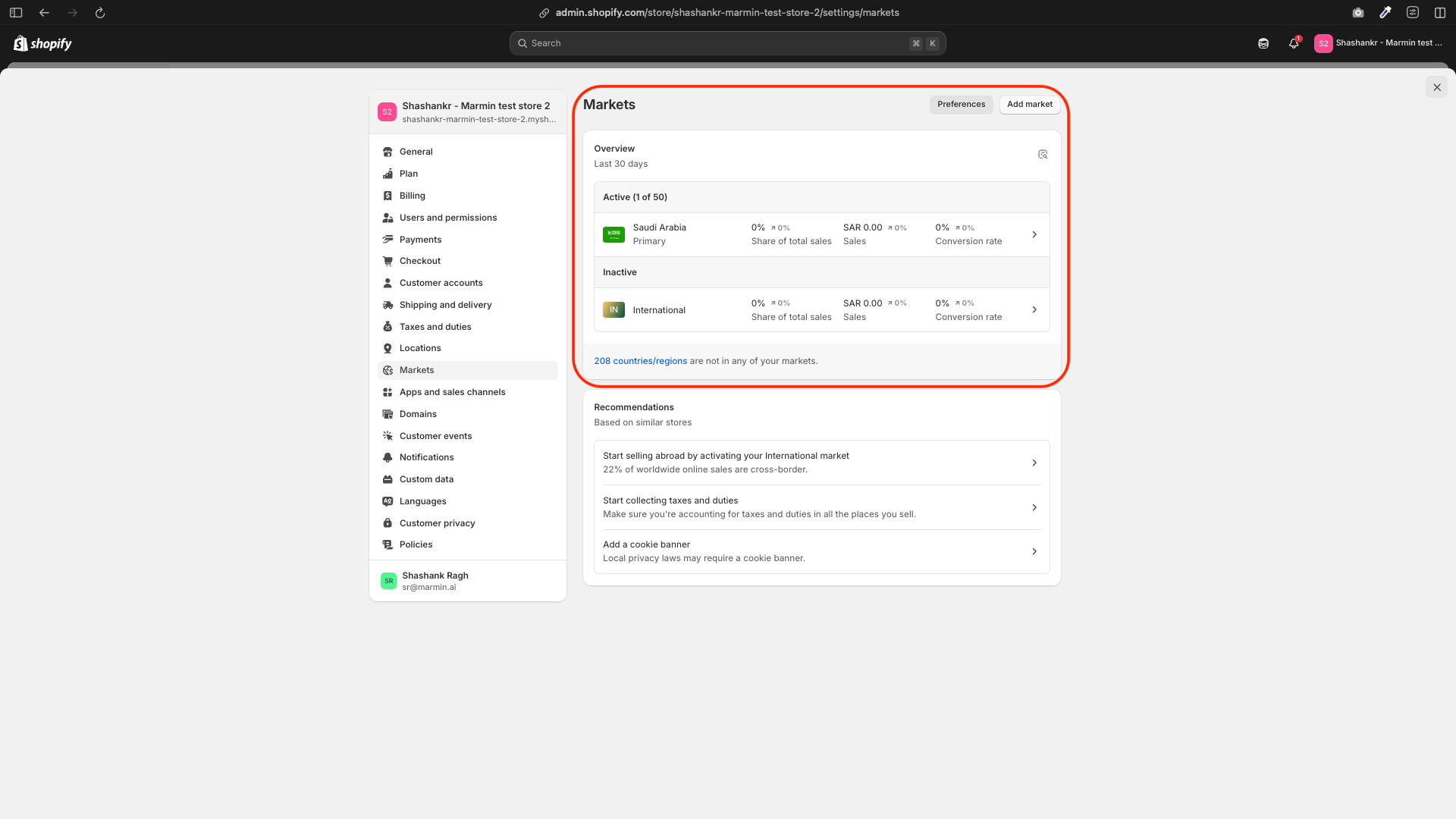

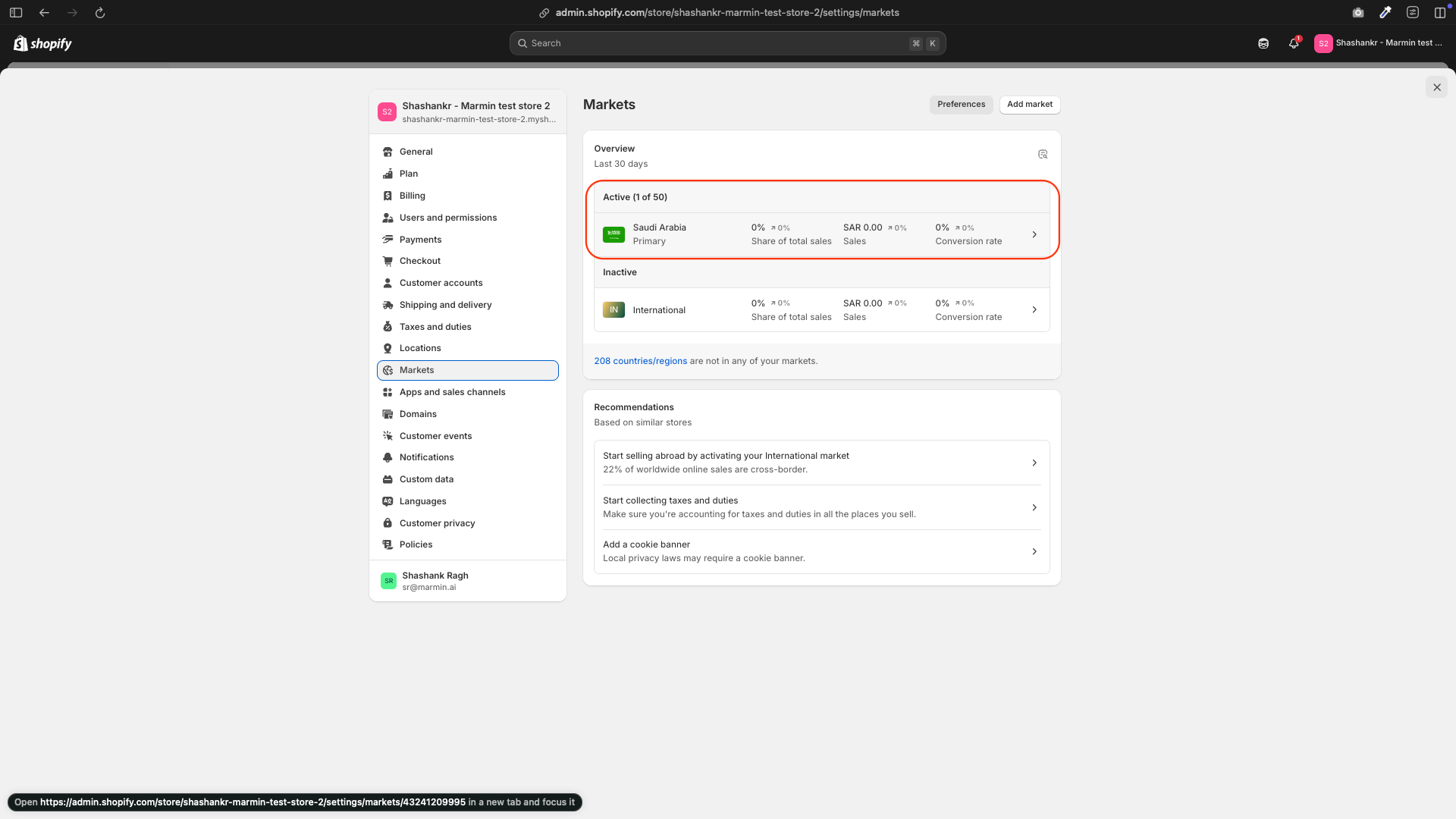

¶ 1. Adding a New Market for Saudi Arabia

¶ 1.1 Add Saudi Arabia as a Market

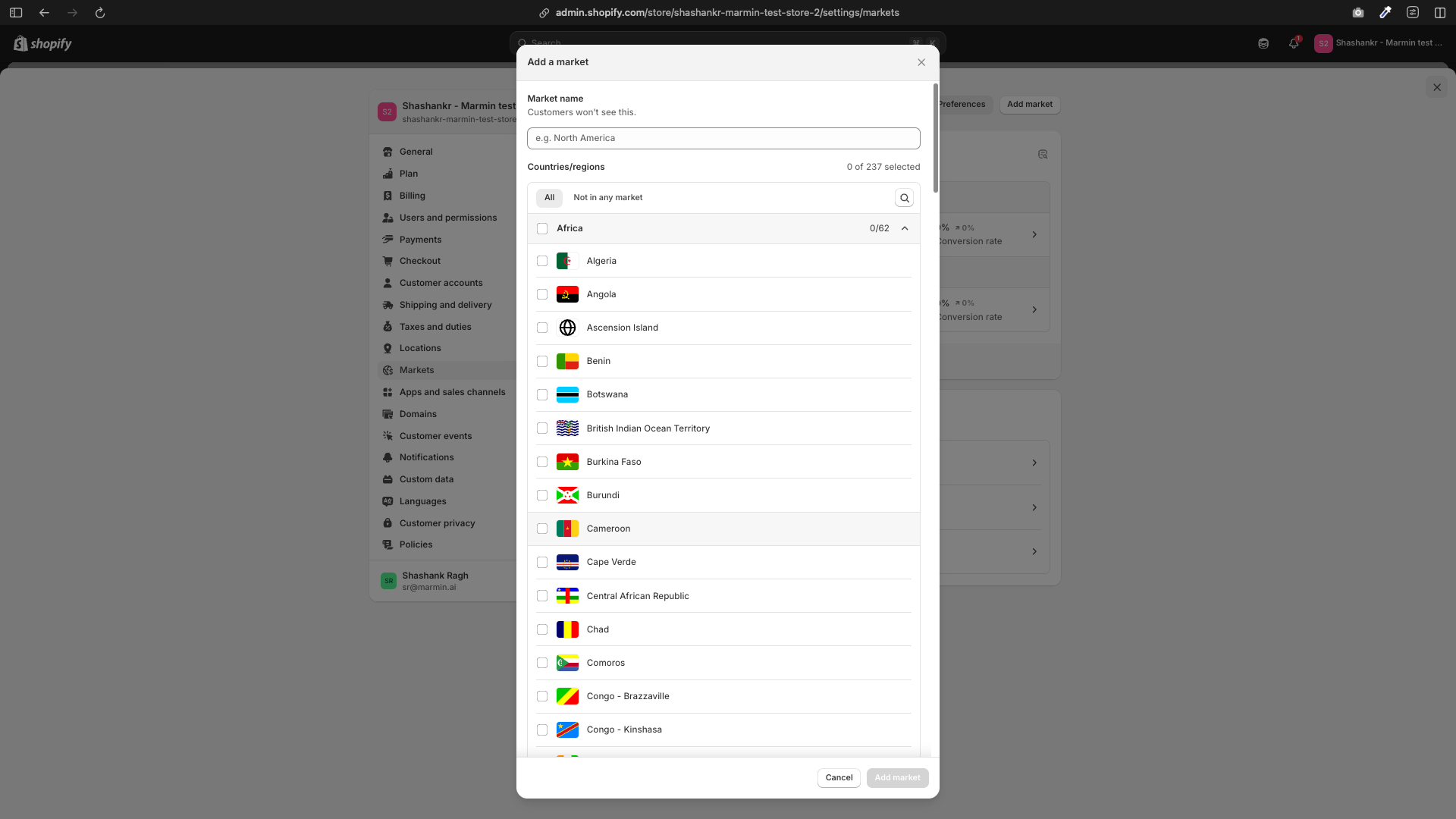

- Go to Settings → Markets.

- Click Add market.

- Select Saudi Arabia from the list of countries.

¶ 1.2 Activate the New Market

To activate the market, you need to set up shipping rates for Saudi Arabia:

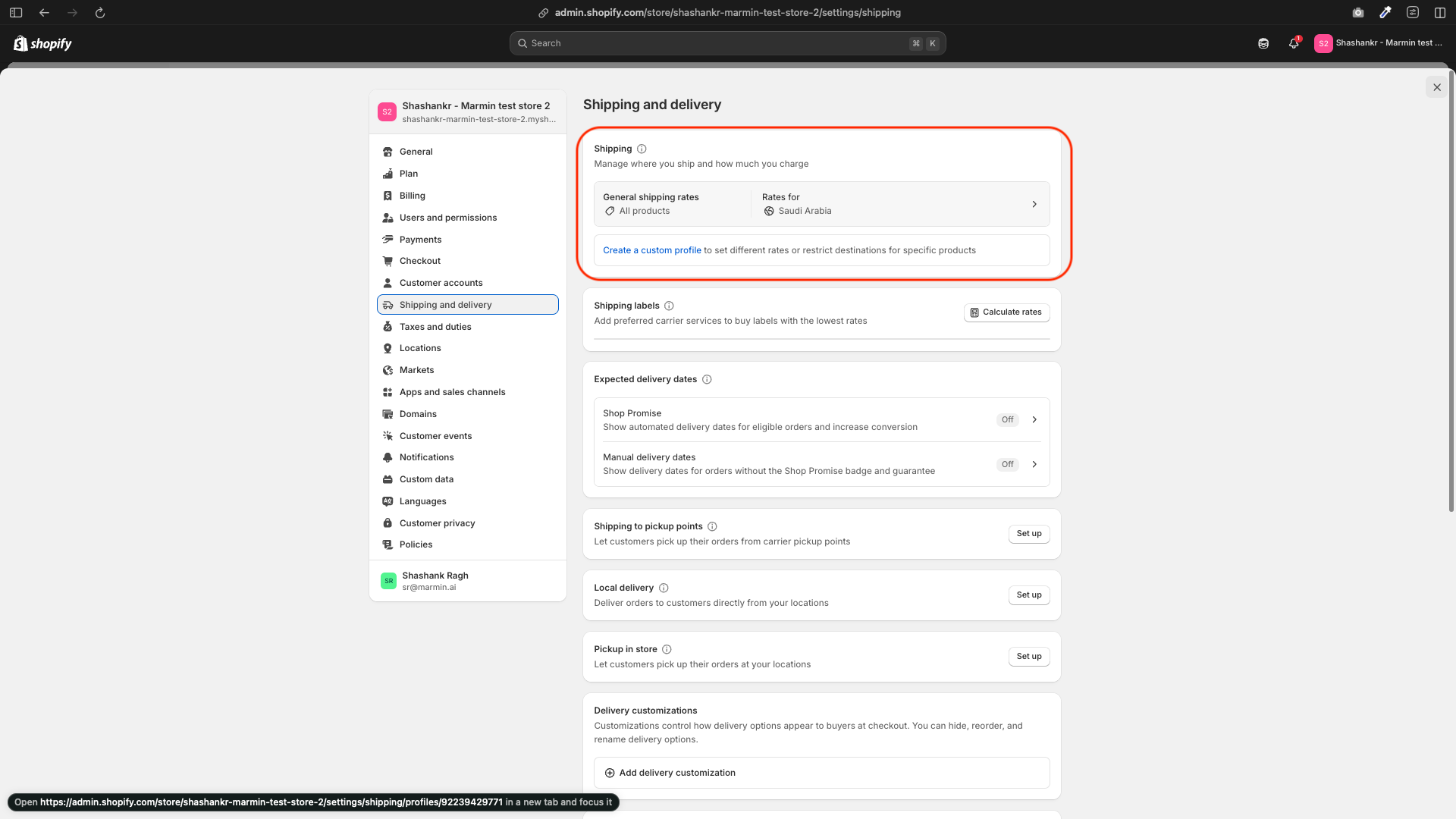

- Go to Settings → Shipping and delivery.

- Under the Shipping section, click Manage rates.

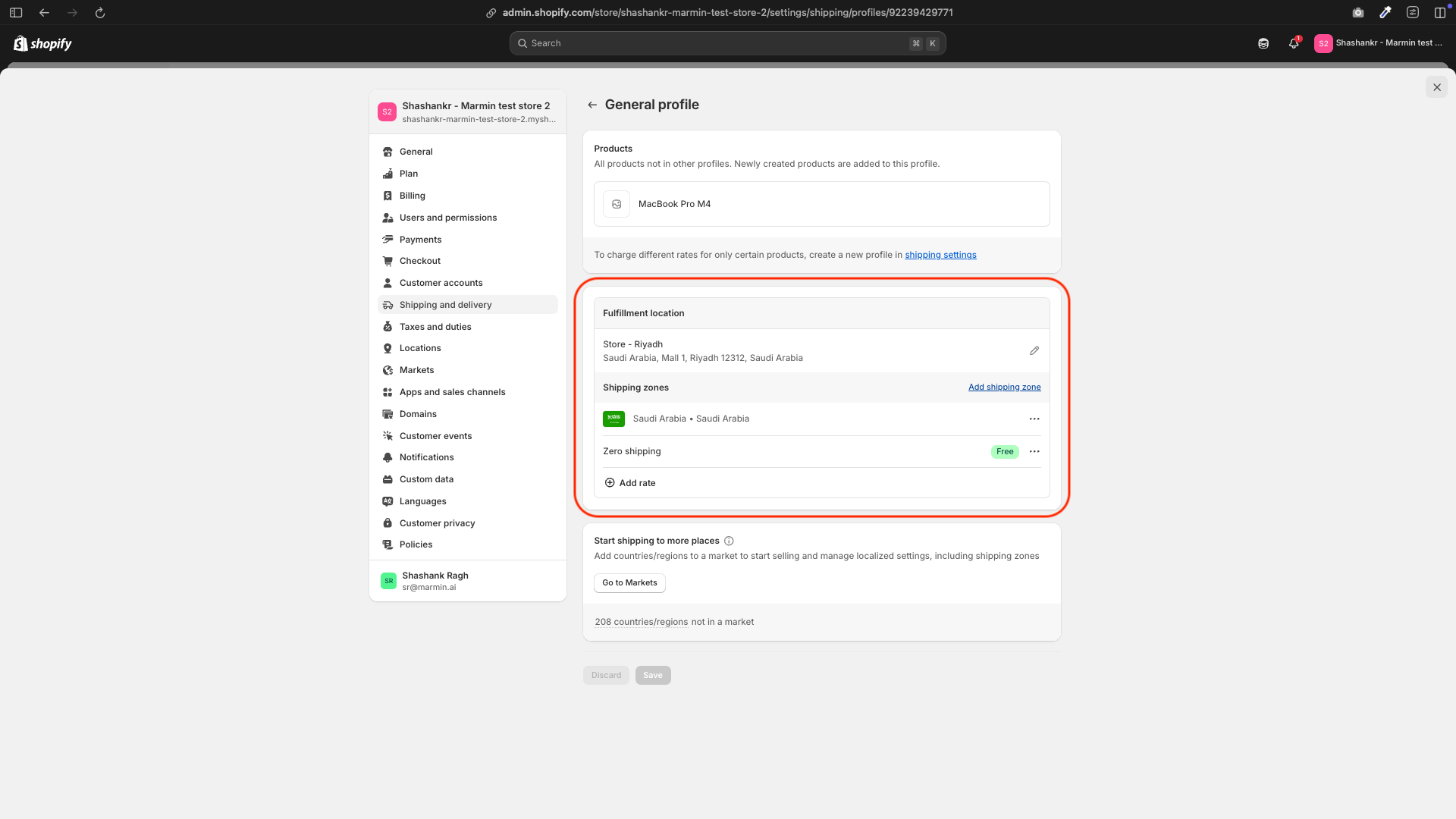

- Click Add shipping zone.

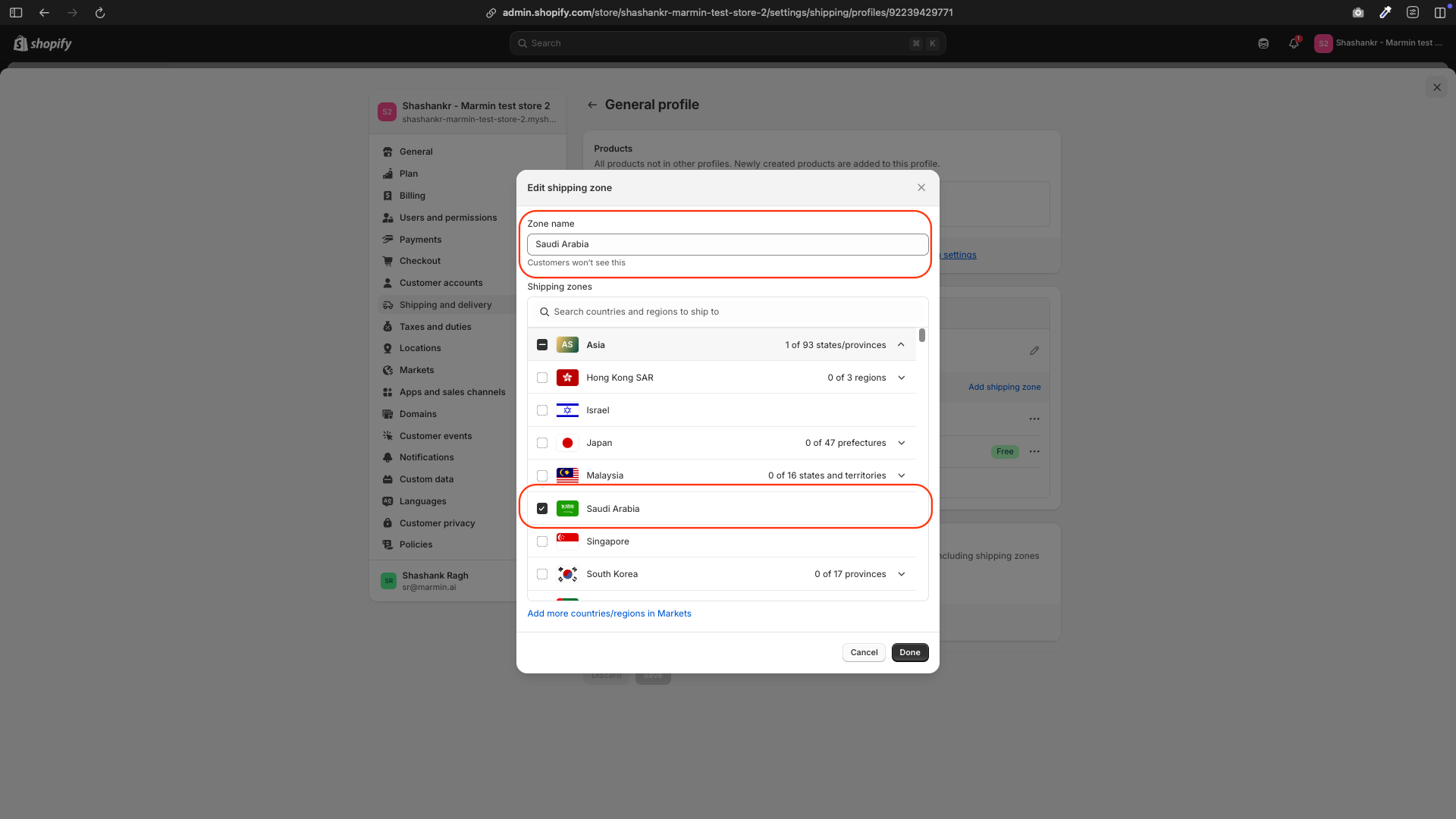

- Name the shipping zone (e.g., “Saudi Arabia”) and select Saudi Arabia as the shipping zone.

- Add the appropriate shipping rates for KSA (e.g., flat rate, free shipping, etc.).

If a shipping zone for Saudi Arabia already exists, edit it to ensure it’s correctly configured.

¶ 1.3 Set Saudi Arabia as the Primary Market

- Go back to Settings → Markets.

- Click on the newly added Saudi Arabia market.

- Activate the market by ensuring all required settings (e.g., shipping) are complete.

- Set Saudi Arabia as the primary market.

- Remove any other markets that are not needed.

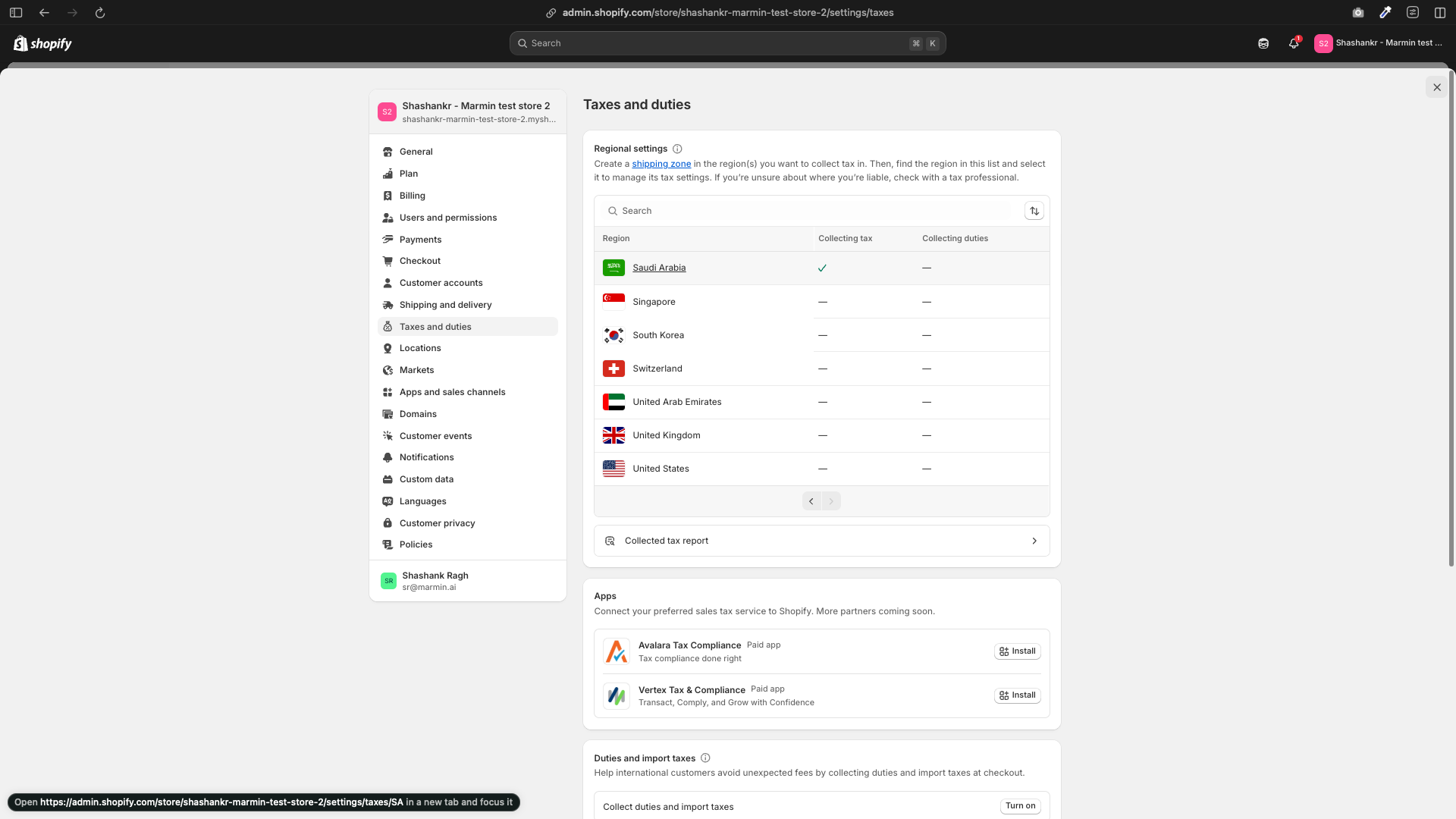

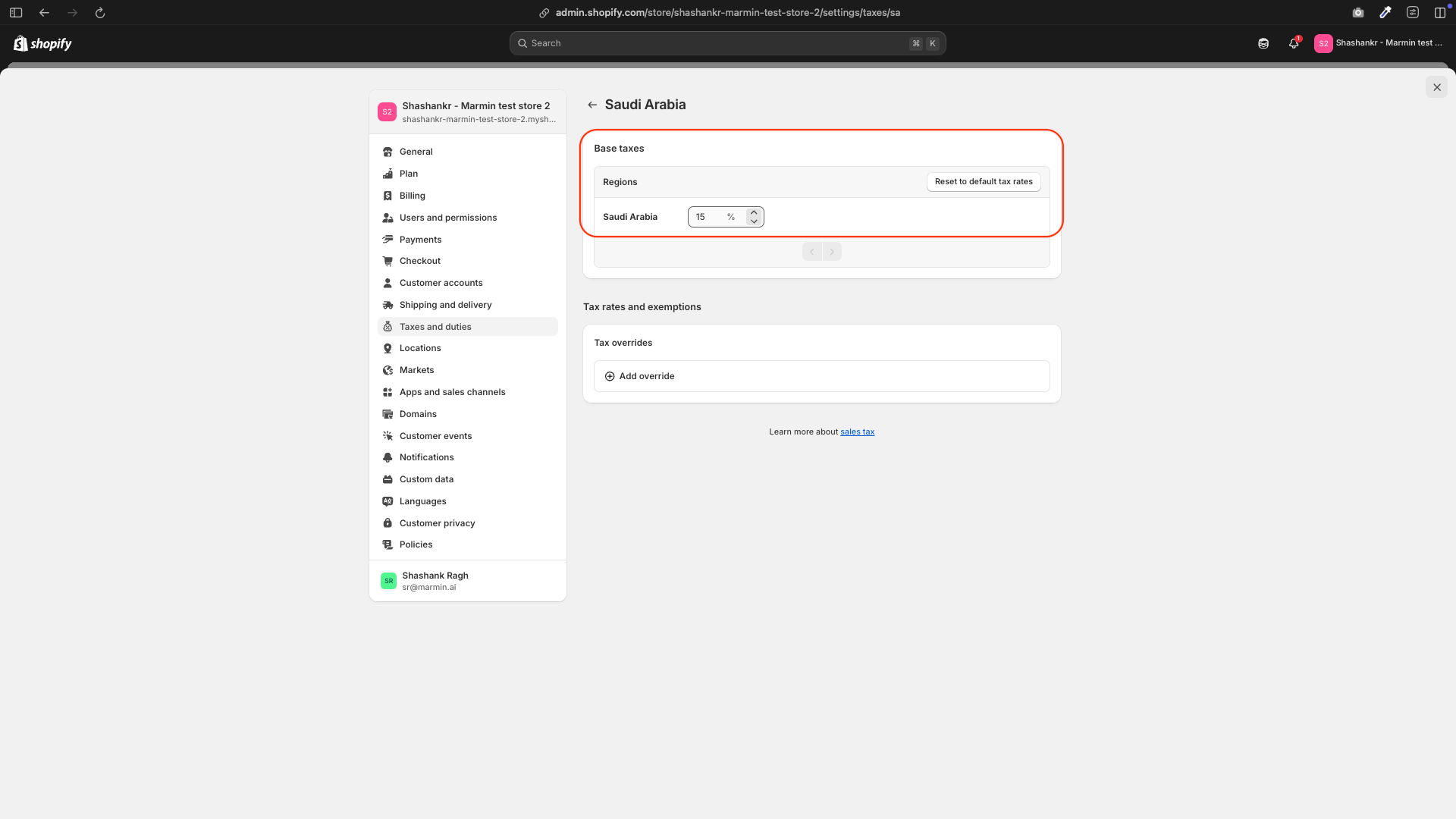

¶ 2. Setting Up Tax Rates for Saudi Arabia

- Go to Settings → Taxes and duties.

- Under Tax regions, click on Saudi Arabia.

- Set the VAT rate to 15% (the standard VAT rate in KSA).

- Ensure the tax settings align with your pricing strategy (tax-inclusive or tax-exclusive).

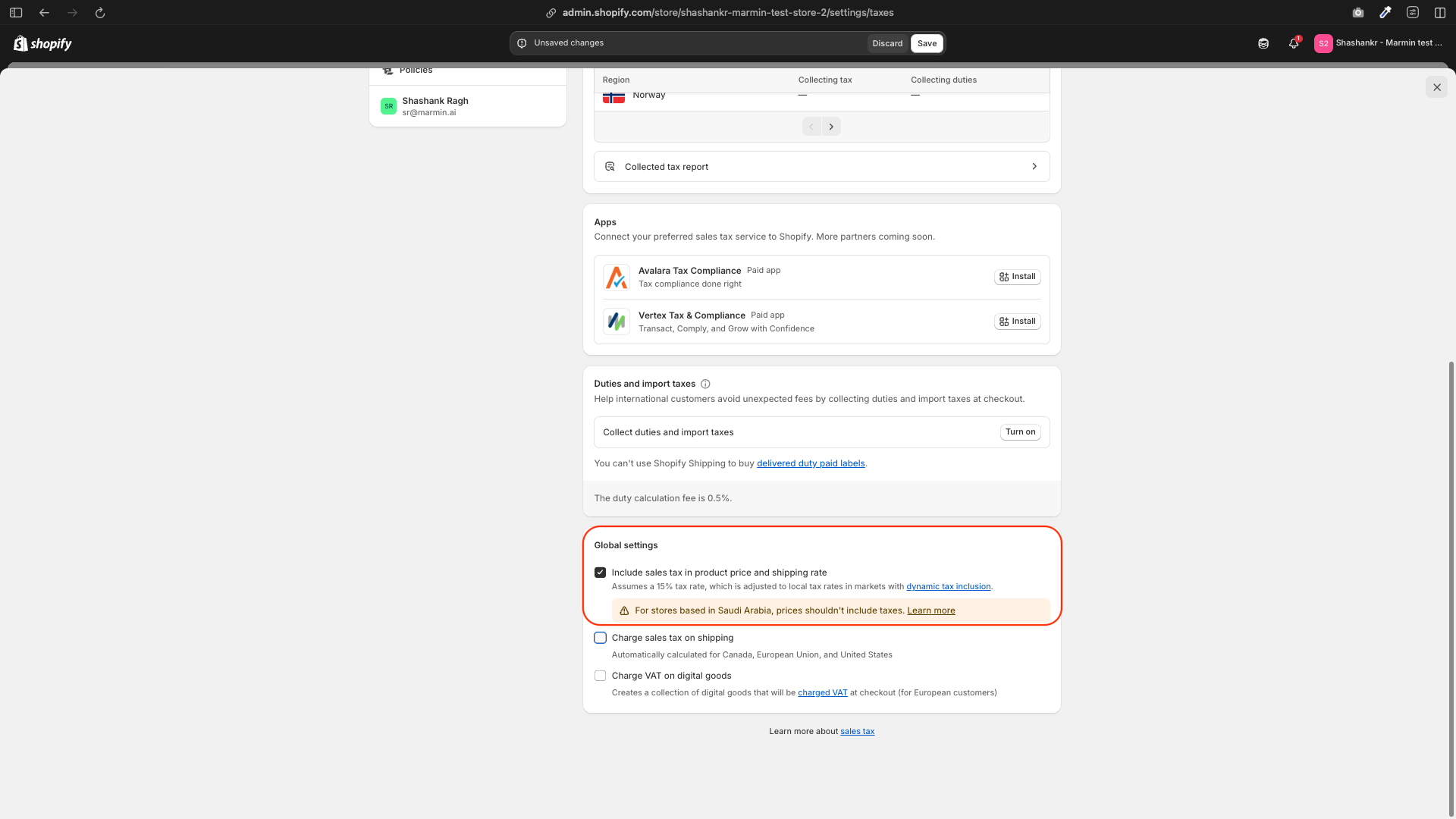

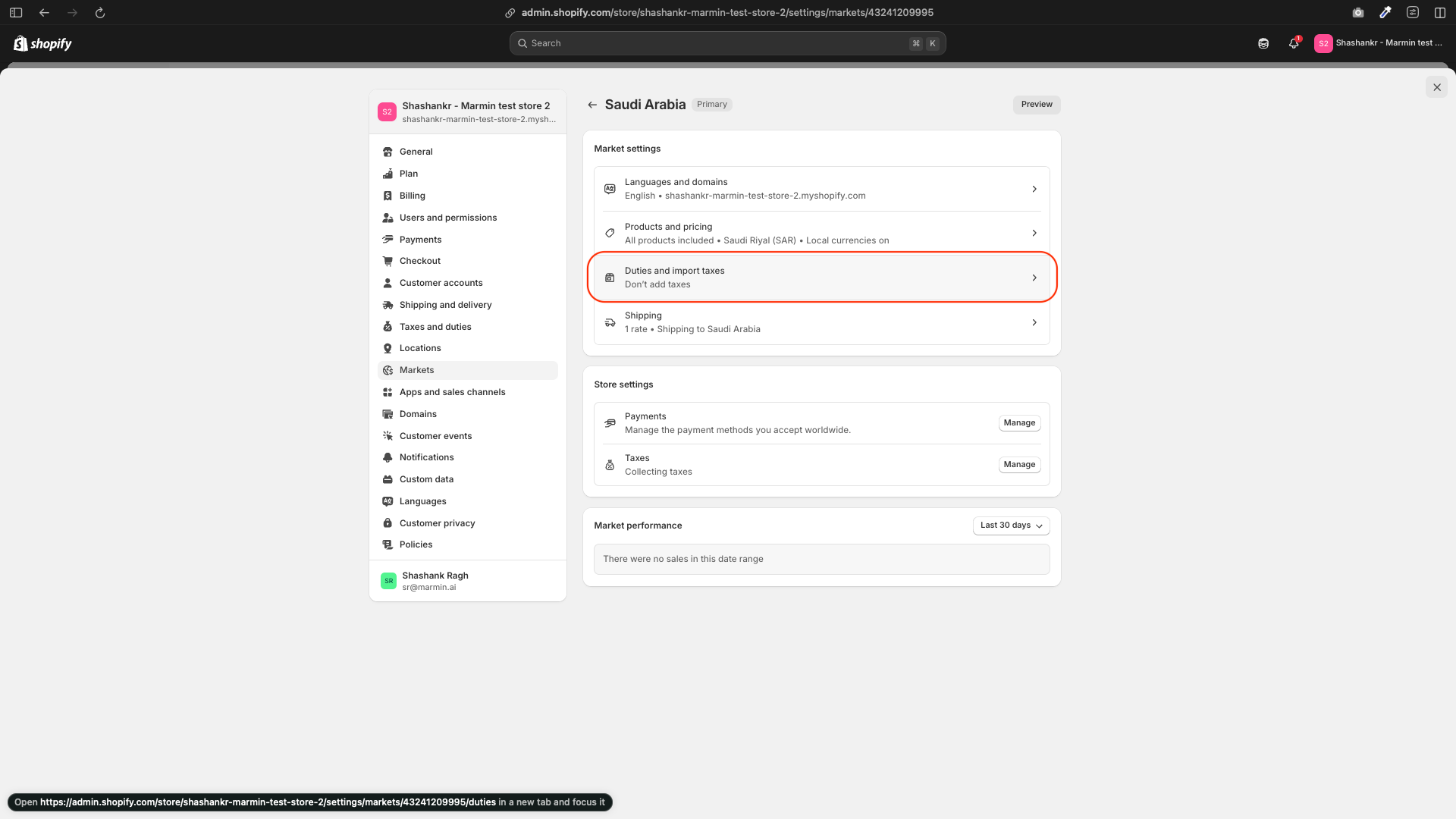

¶ 3. Setting Tax-Inclusive or Tax-Exclusive Pricing

¶ 3.1 For Tax-Inclusive Pricing

- Go to Settings → Taxes and duties.

- Under Global settings, enable Include sales tax in product price and shipping rate.

- Go to Settings → Markets → Saudi Arabia.

- Under Duties and taxes, ensure Storefront and checkout pricing is set to “Don’t add taxes”.

¶ 3.2 For Tax-Exclusive Pricing

- Go to Settings → Taxes and duties.

- Under Global settings, disable Include sales tax in product price and shipping rate.

- Under Duties and taxes, ensure Storefront and checkout pricing is set to “Add taxes at checkout”.

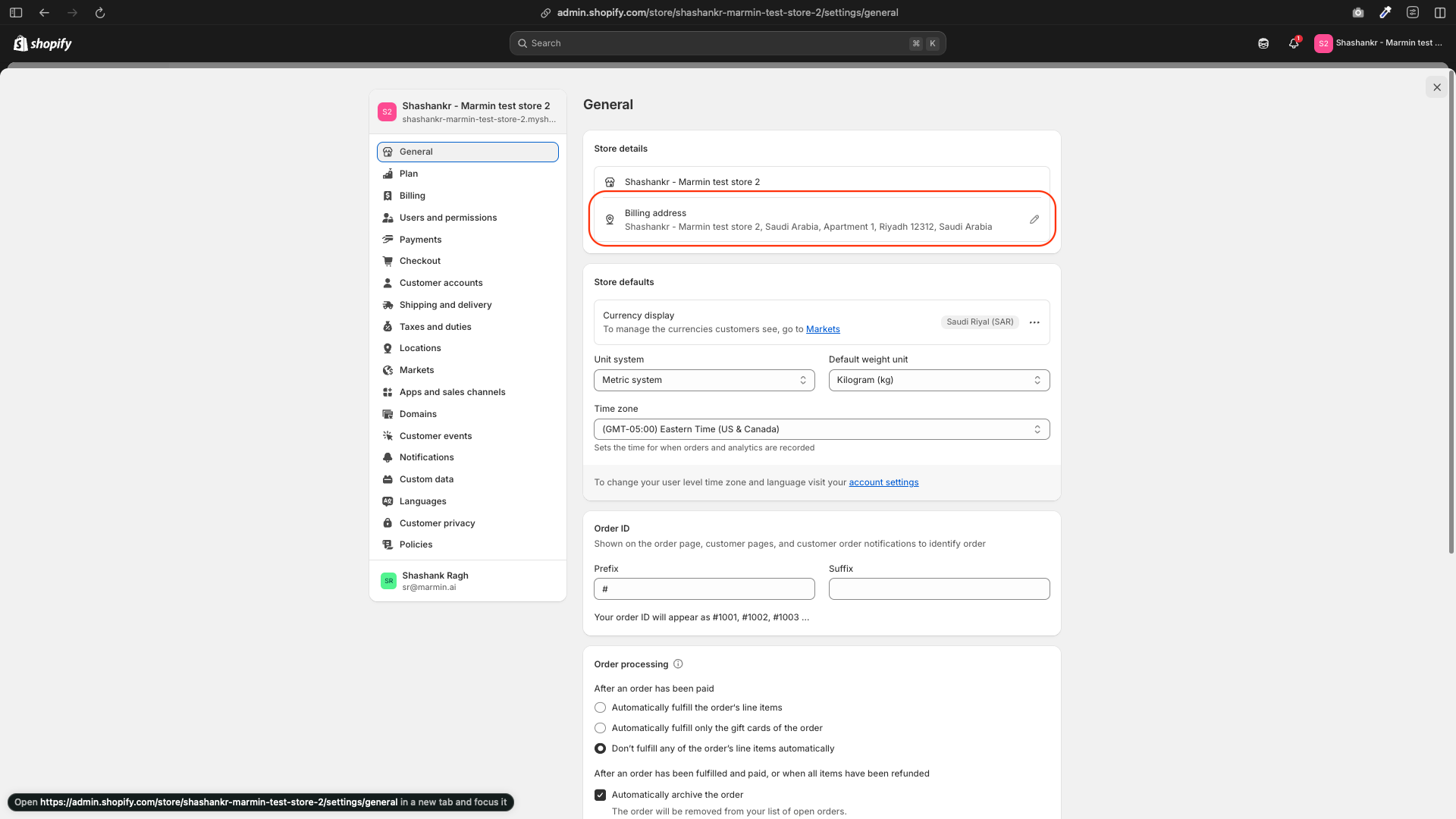

- Store Address: Ensure your store address is set to Saudi Arabia in Settings → Store details. This is important for tax calculations and market settings.

Note: Your store’s address in the Shopify admin determines the home tax rate. If you change your store’s address to another country, the tax rate will adjust accordingly.

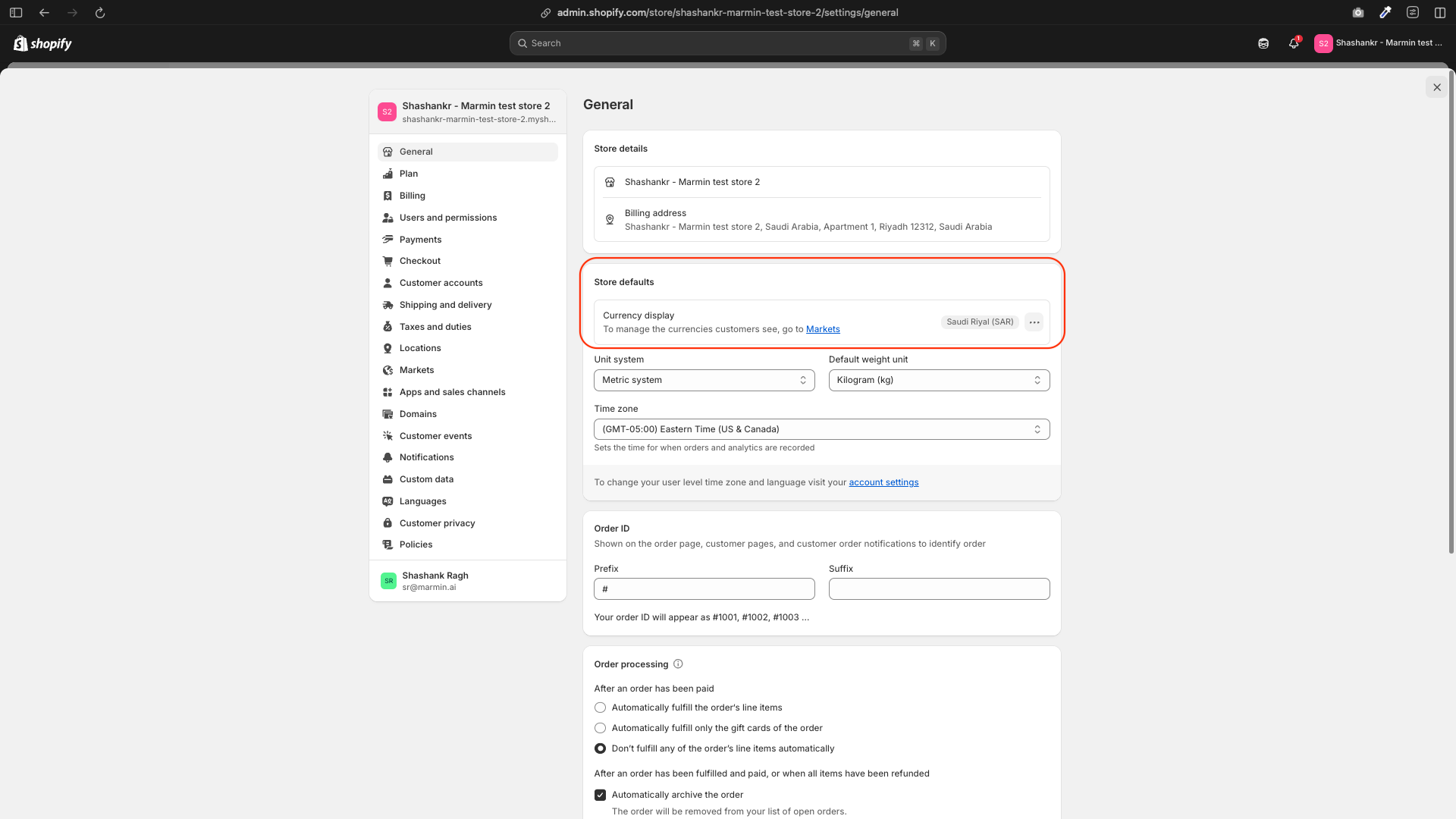

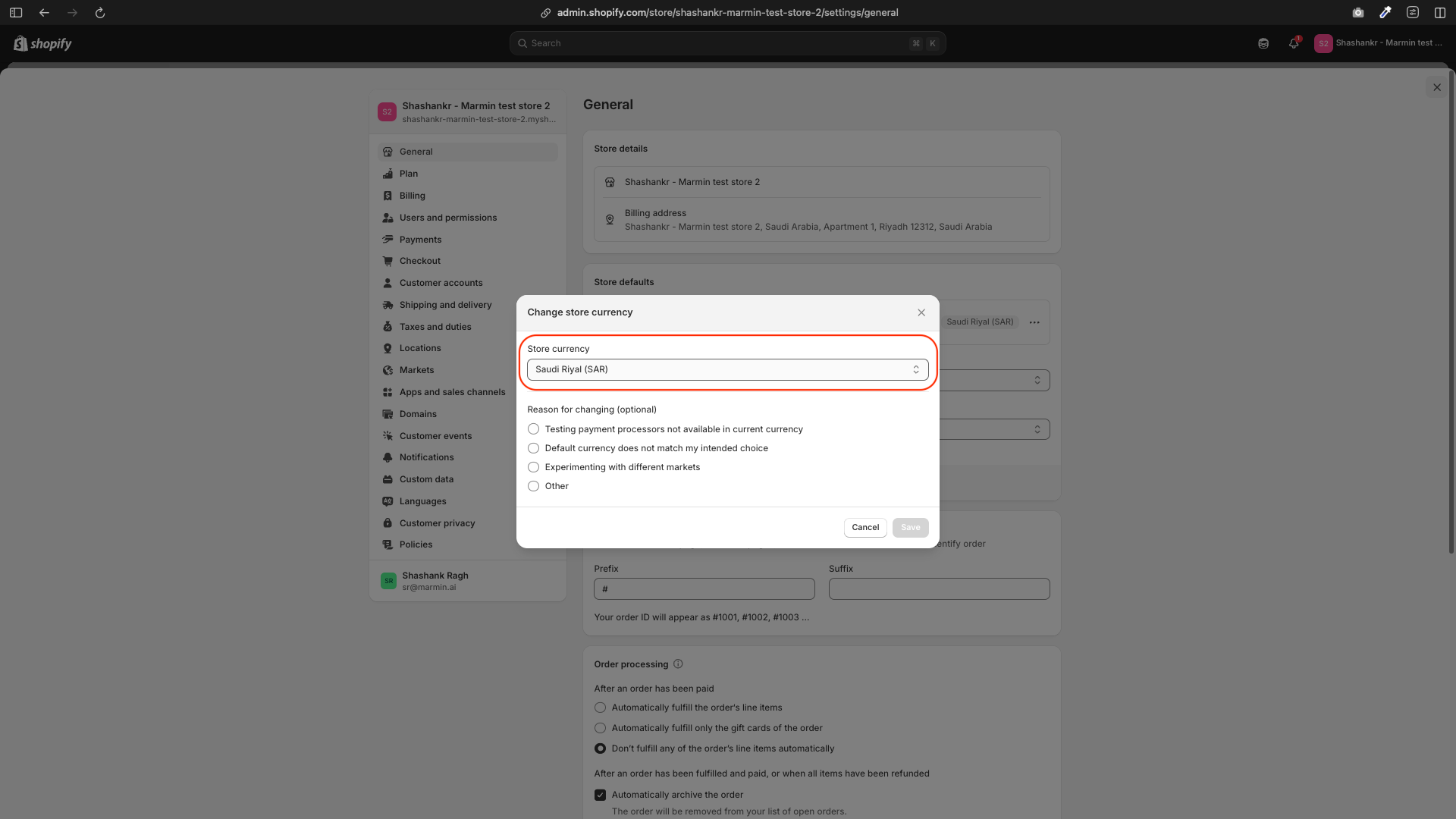

¶ 4. Setting the Store Currency

- Go to Settings → Store details.

- Under Store currency, select Saudi Riyal (SAR).

¶ Summary of Steps

- Add and activate Saudi Arabia as a market.

- Set up shipping zones and rates for KSA.

- Configure the 15% VAT rate.

- Choose between tax-inclusive or tax-exclusive pricing.

- Set the store currency to SAR.